oklahoma auto sales tax rate

With local taxes the total sales tax rate is between 4500 and 11500. When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including.

How Do State And Local Property Taxes Work Tax Policy Center

The Oklahoma sales tax rate is currently.

. Until 2017 motor vehicles were fully exempt from the sales tax but under HB. Lowest sales tax 485 Highest sales tax 115 Oklahoma Sales Tax. That must be added to the city tax and the State Tax.

Counties and cities can charge an additional local sales tax of up to 65 for a. Typically the tax is determined by. Oklahoma also has a vehicle excise tax as follows.

Excise tax is assessed upon each transfer of vehicle all terrain vehicle boat or outboard motor ownership unless specifically exempted. States with some of the highest sales tax on cars include Oklahoma 115 Louisiana 1145 and Arkansas 1125. The minimum is 725.

Multiply the vehicle price before trade-in or incentives by the sales. The state sales tax rate in Oklahoma is 4500. The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877.

To calculate the sales tax on your vehicle find the total sales tax fee for the city. The county the vehicle is registered in. This is the total of state county and city sales tax rates.

325 percent of the purchase price. Sales tax on all vehicle purchases in Oklahomaeven used carsis 125. The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877.

In addition to the 125 sales tax buyers are also charged a 325 excise tax on all new vehicle. Average Sales Tax With Local. The excise tax for new cars is 325 and for used cars the tax is 2000 for the first 150000 and 325 on the remainder of the sale price.

Oklahoma has recent rate changes Thu Jul 01 2021. Tag Tax Title Fees Unconventional Vehicles Boats Outboard Motors Rules Policies IRP IFTA 100 percent Disabled Veterans Sales Tax Exemption Motor Vehicle Exemption Ad. In Oklahoma this will always be 325.

Denotes Use Tax is due for sales in this city or county from out-of-state at the same rate as shown. 20 on the first 1500 plus 325 percent on the remainder. 31 rows The state sales tax rate in Oklahoma is 4500.

Excise tax is often included in the price of the product. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. Check prior accidents and damage.

The minimum combined 2022 sales tax rate for Woodward Oklahoma is. Multiply the vehicle price after trade-ins and incentives. 609 rows 2022 List of Oklahoma Local Sales Tax Rates.

This is also in addition to the State.

How To Calculate Sales Tax How To Find Out How Much Sales Tax Sales Tax Calculation Youtube

No Kidding Four Orange County Cities Boost Sales Taxes On April Fools Day Orange County Register

What S The Car Sales Tax In Each State Find The Best Car Price

Used Cars For Sale In Oklahoma City Ok Cars Com

Owasso Oklahoma Business And Sales Tax Rates

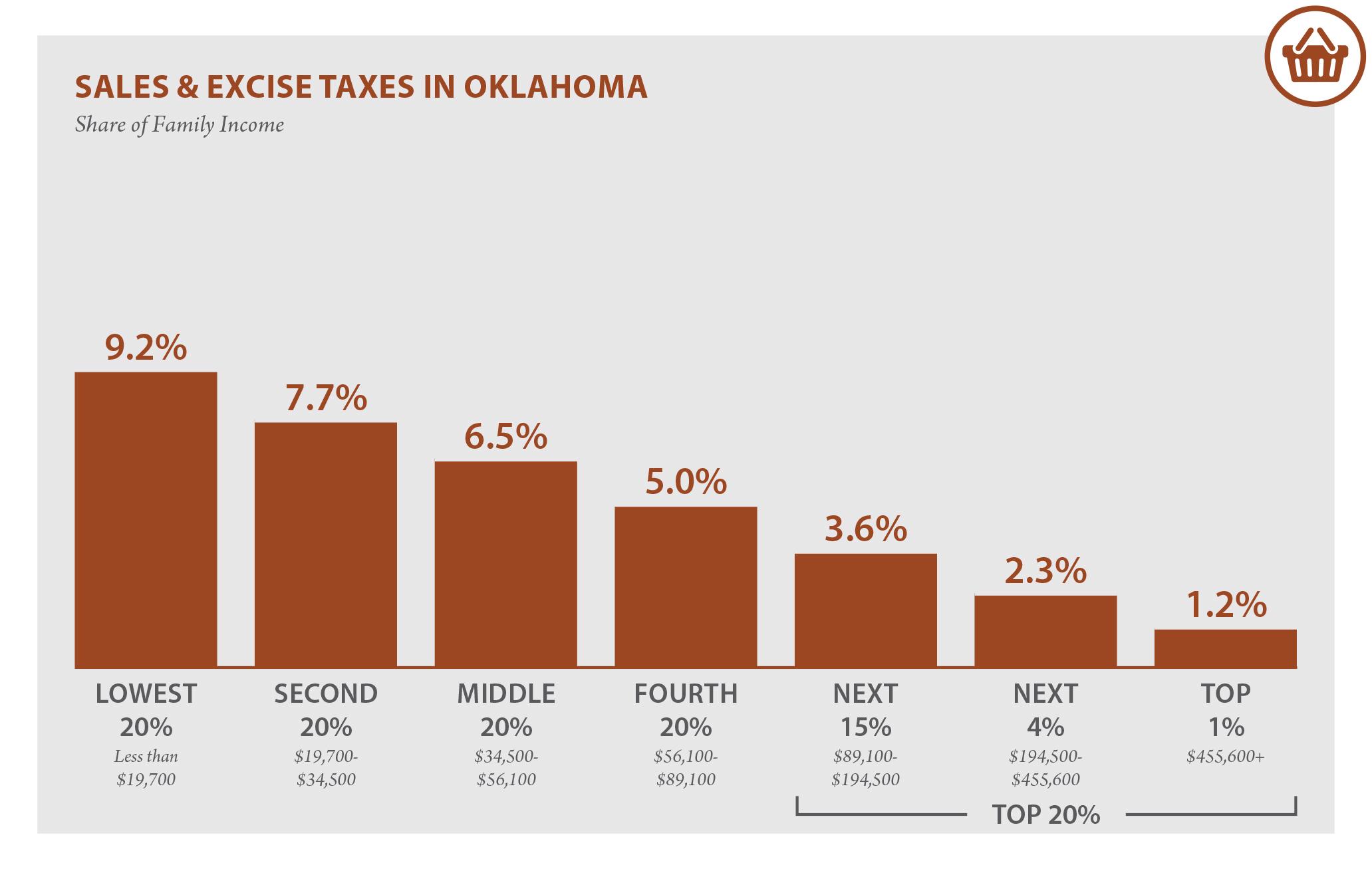

Oklahoma Who Pays 6th Edition Itep

Understanding California S Sales Tax

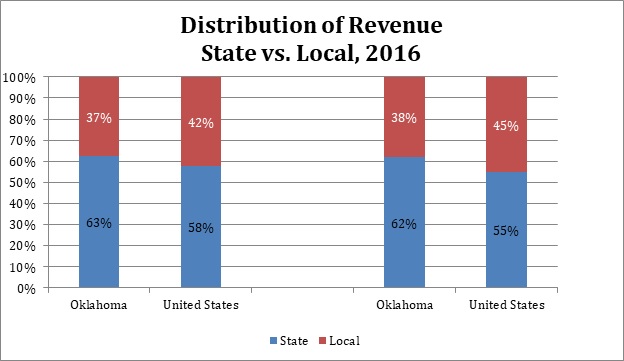

State And Local Tax Distribution Oklahoma Policy Institute

Update State Will Email Free Registration Certificates After Law Change That Also Keeps Plates With The Driver

Local Tax Information City Of Enid Oklahoma

Which U S States Charge Property Taxes For Cars Mansion Global

Car Tax By State Usa Manual Car Sales Tax Calculator

If I Buy A Car In Another State Where Do I Pay Sales Tax

Oklahoma City Tax Title License Fees

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Free Oklahoma Motor Vehicle Bill Of Sale Form Pdf Word

Amendments Would Eliminate Oklahoma Grocery Tax While Raising Sales Gpt Tax Rates

How Do State And Local Property Taxes Work Tax Policy Center